Interest Rates Cut This Week!

Federal Reserve Cuts Rates by 0.5 Percentage Points

In a bold move today, the Federal Reserve announced a 0.5 percentage point cut to interest rates, marking a decisive effort to stimulate the economy. This reduction aims to lower borrowing costs while encouraging investment and consumption.

Fed Chair Jerome Powell highlighted that this decision was made in light of mixed economic indicators. While inflation has shown signs of moderation, recent reports of sluggish job growth and reduced consumer confidence prompted the need for action. By cutting rates, the Fed seeks to provide a boost to the economy, making loans for mortgages, cars, and business investments more affordable.

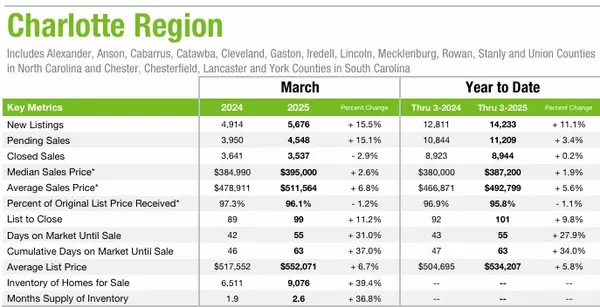

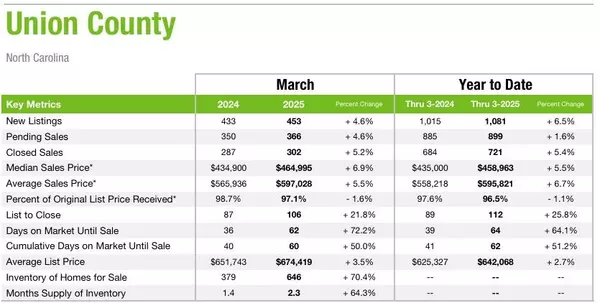

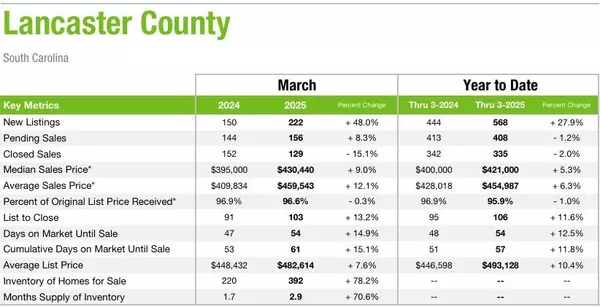

Market reactions were largely positive following the announcement, with stock indices rising as investors responded to the anticipated increase in liquidity. Analysts believe this rate cut could lead to enhanced consumer spending, particularly in sectors like housing and retail, which have faced challenges in recent months.

However, the Fed remains cautious, emphasizing the need for careful monitoring of inflation trends and economic data. Powell noted that while the current cut is intended to foster growth, the central bank is committed to addressing any resurgence in inflation that may arise as a result of increased spending.

As the economy adapts to this new monetary policy, the implications of the rate cut will unfold in the coming months. The Fed’s proactive stance could pave the way for a more resilient economic environment, but it will need to remain agile in response to evolving conditions. This decision may signal a new phase in monetary policy, balancing growth objectives with inflation management as the economy navigates uncertain waters.

Categories

Recent Posts