How Mortgage Rate Trends Are Shaping the Charlotte Market for Buyers and Sellers

Source: Mortgage News Daily

Source: Mortgage News DailyMortgage rates have been on a bit of a rollercoaster lately, but the good news is that they’ve started to come down after last year’s highs. If you’ve been feeling stuck—whether you’re looking to buy or sell—a shift may finally be happening in your favor.

For buyers, lower rates mean monthly payments might be a little more manageable, which is a welcome change after months of rising home prices. Charlotte’s median home price is now around $422,605, so any break in borrowing costs can make a big difference. But with more buyers jumping back in, competition could pick up again, especially for homes in popular areas.

Sellers are also starting to make moves. Many people held off listing their homes because they didn’t want to give up their low mortgage rates. Now, with rates trending down, more homes are hitting the market. That’s great for buyers looking for options, but it also means sellers may need to be more thoughtful about pricing and presentation to stand out.

It’s an interesting time in Charlotte real estate—things aren’t quite where they were a couple of years ago, but the market is still strong and full of opportunities. If you’re curious about what all this means for you, I’m happy to chat. No pressure, just good conversation about what’s next for you and your home!

Categories

Recent Posts

May 2025 City Market Statistics

York County May 2025 Market Statistics

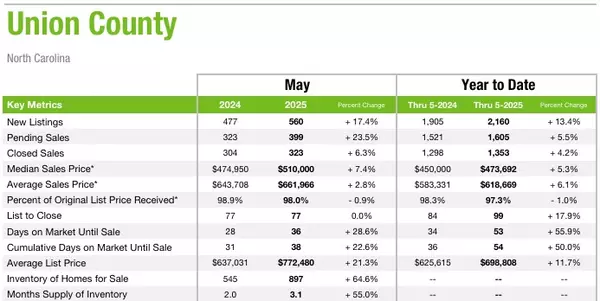

Union County May 2025 Market Statistics

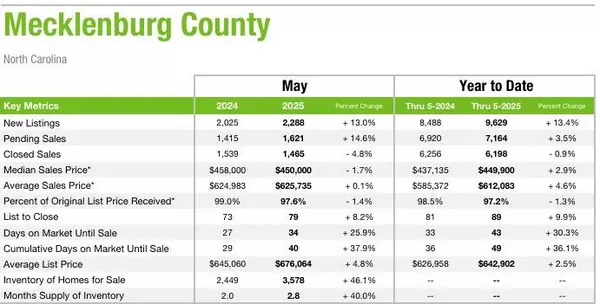

Mecklenburg County May 2025 Market Statistics

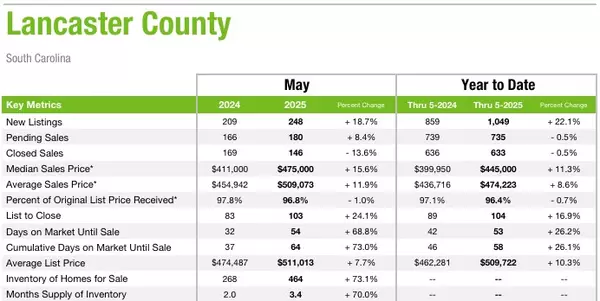

Lancaster County May 2025 Market Statistics

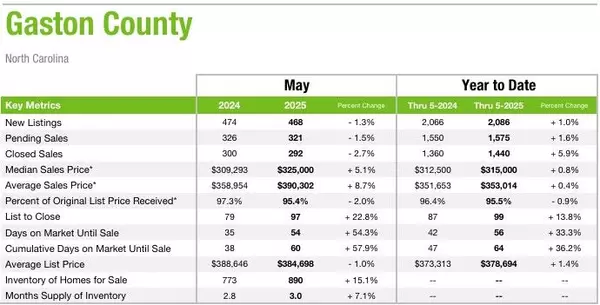

Gaston County May 2025 Market Statistics

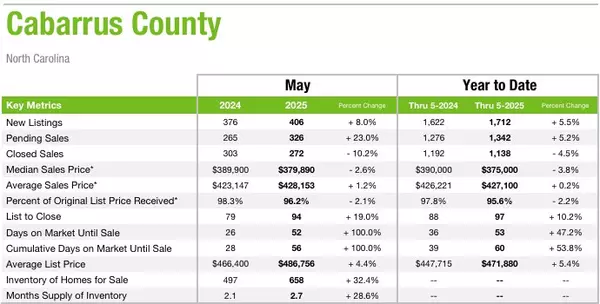

Cabarrus County May 2025 Market Statistcs

Charlotte Region May 2025 Market Statistics

Navigating Charlotte's Evolving Housing Market: Insights for Buyers and Sellers

Understanding Charlotte's Market Today: How Long Should My Home Take to Sell?